Rachel Reeves’ First Budget: Implications for Woodlands and Forestry

In her first budget as Chancellor, Rachel Reeves introduced a series of tax adjustments intended to raise additional revenue. While the headline measure was an increase in employers’ National Insurance contributions, two other changes have a more direct impact on woodland and forestry owners: a rise in Capital Gains Tax (CGT) and a reduction in Agricultural Property Relief (APR).

Capital Gains Tax: Higher Rates, Immediate Impact

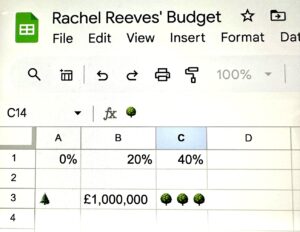

The increase in CGT, from 20% to 24%, is likely to influence woodland sales and ownership decisions. Unlike agricultural land, CGT  on woodlands applies only to the increase in land value, not the timber growing on it. This distinction benefits woodland owners by allowing them to potentially reduce their CGT liability, provided they obtain valuations for the timber at the time of purchase and sale.

on woodlands applies only to the increase in land value, not the timber growing on it. This distinction benefits woodland owners by allowing them to potentially reduce their CGT liability, provided they obtain valuations for the timber at the time of purchase and sale.

However, the higher rate may discourage woodland sales, as owners now face a larger tax bill. With the effect of the rate increase being immediate, many owners may choose to hold onto their woodlands for longer, which could have an indirect impact on the supply and demand of land suitable for forestry.

Agricultural Property Relief: Tightening Inheritance Tax Relief

Agricultural Property Relief, or APR, is a longstanding relief mechanism that exempts certain landowners from Inheritance Tax (IHT) if the land is classified as agricultural. While it might not seem relevant to forestry, commercially managed woodlands qualify under APR, allowing woodland owners to reduce their IHT burden, often to zero. However, Reeves’ budget has placed new limits on this relief.

Agricultural Property Relief, or APR, is a longstanding relief mechanism that exempts certain landowners from Inheritance Tax (IHT) if the land is classified as agricultural. While it might not seem relevant to forestry, commercially managed woodlands qualify under APR, allowing woodland owners to reduce their IHT burden, often to zero. However, Reeves’ budget has placed new limits on this relief.

Under the new rules, commercially managed woodlands valued up to £1 million will still benefit from IHT relief. However, for estates exceeding this value, the IHT exemption is now capped, with any value over £1 million taxed at a reduced rate of 20% rather than the usual 40%. While the cap still offers a significant tax advantage, the change is a blow to larger woodland estates, many of which previously enjoyed full exemption.

How Big Landowners are Affected

This shift in APR has sparked a backlash among prominent landowners. Jeremy Clarkson, known for his 1,000-acre farm, and James Dyson, who owns roughly 36,000 acres, are among those likely to be impacted. For estates of this scale, even at the reduced IHT rate, tax liabilities could amount to millions: roughly £2 million for Clarkson and up to £72 million for Dyson. However, the budget changes leave room for maneuver. Landowners can avoid these new IHT liabilities by transferring land to their heirs well in advance of their passing, with a minimum of seven years required to ensure these assets fall outside of IHT calculations.

This shift in APR has sparked a backlash among prominent landowners. Jeremy Clarkson, known for his 1,000-acre farm, and James Dyson, who owns roughly 36,000 acres, are among those likely to be impacted. For estates of this scale, even at the reduced IHT rate, tax liabilities could amount to millions: roughly £2 million for Clarkson and up to £72 million for Dyson. However, the budget changes leave room for maneuver. Landowners can avoid these new IHT liabilities by transferring land to their heirs well in advance of their passing, with a minimum of seven years required to ensure these assets fall outside of IHT calculations.

Smaller Woodland Owners: Minimal Impact

For smaller woodland owners, the impact of this budget is limited. Estates under £1 million in value will retain full APR benefits, and as long as their woodlands are commercially managed—whether by having a management plan or demonstrating some level of timber income—the IHT relief will remain. Timber income remains tax-free, and woodlands are still exempt from business rates, leaving smaller owners largely untouched by the budget changes.

For smaller woodland owners, the impact of this budget is limited. Estates under £1 million in value will retain full APR benefits, and as long as their woodlands are commercially managed—whether by having a management plan or demonstrating some level of timber income—the IHT relief will remain. Timber income remains tax-free, and woodlands are still exempt from business rates, leaving smaller owners largely untouched by the budget changes.

Final Thoughts

While the budget introduces challenges for some, particularly larger landowners, smaller woodland owners who manage their land commercially are less affected. The Chancellor's adjustments aim to close gaps that previously benefited wealthy estates while preserving essential reliefs for those managing woodlands as smaller, income-generating enterprises. As the dust settles, these changes may encourage long-term holding strategies among larger estates, potentially reshaping the landscape of woodland ownership and management in the UK.

Comments are closed for this post.

What if a small wood – 24 acres- is not commercially viable and owned as an amenity?

Ian Gouldsbrough

5 December, 2024